|

| As I sit and ponder . . . |

By now, I'm sure readers believe I think placing your savings in just silver is a good idea. Let me be clear on this.

I DO NOT believe that.

I believe that you need to develop some type of a savings portfolio which includes a variety of areas in which you place your savings. However, most people fail to save with any precious metals. I have no idea what percent have physical silver or gold in their portfolio, but my guess would be close to zero. We silver bugs and numismatists are a small minority.

Savings, of any sort, needs to be your first expense! If you try to save a little "extra" each month, after paying bills and enjoying life, you will never get to your goal. Savings is first. Here I sit typing that - when I have never done it myself (until very recently).

Hey. Just because I have made mistakes doesn't mean you should!

The second rule (mine) is that once you decide what areas you need to get into with investing, you need to do them one at a time. Might I suggest you start with silver? You knew I was headed there didn't you? I find saving silver to be a great deal of fun, and if you give it a try, I think you will as well. What more could you ask of a savings account than that? So, decide how much your total goal is first. Let's say just for easy numbers, you decide to save a hundred-thousand dollars. I know, I know - cash is trash. But, for now it is still needed. I picked a hundred-thousand because it is so easy to figure out - not because it is in any way a practical figure for your goal. Using "dollar" values for now is little more than a "score card". What amount you choose is entirely up to you.

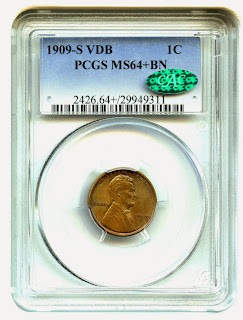

Of my stated goal of a hundred-thousand you decided to save twenty-thousand in precious metals, at today's dollar prices. Buying, for example, ten-thousand in bullion and another ten in coins in one form or another. Assuming you have a safety net of guaranteed income and/or a little emergency stash, you are ready to focus.

BUY SILVER! Don't buy CDs, IRAs etc. Just silver (or gold) - until your goal is reached. I picked silver as the first item for the practical reasons that it is pretty low in dollar value right now and the potential for a huge increase in value (dollar costs) practically overnight is a real possibility.

After you reach the stated goal (yours) in silver then go buy stocks, bonds, IRAs and CDs. Toss in a savings account paying .05% (or so) interest if you want. So, after a while you will have that 100K with 20K in precious metals and 80K in paper assets.

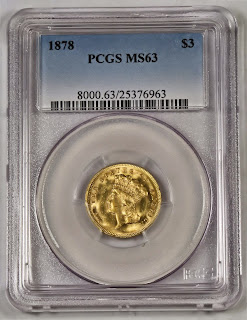

If along the way you obtain enough silver to be too heavy to carry with you in an emergency or simply to bulky to store, you may want to transition to gold. Most of my blog focuses on silver - so I have added this section to cover this possible need. The ratio between gold and silver is discussed elsewhere in here so I needn't go there now. However, at the current ratio, silver can become pretty heavy and begin to take up a lot of storage space. You may reach that point and still want to put precious metals back for the impending crash or whatever. In this case you should consider gold.

I understand the current gold price is high enough to make it too costly to just transition to gold after silver. Plus, I am in no way suggesting you sell or swap out silver for gold whatever the value and ratio is. However, there are smaller denominations in gold making it more affordable in dollars today. Yes, those smaller denominations cost more per ounce, just as with silver. However, it still presents a more affordable method of owning smaller amounts of gold today. After a time those smaller coins add up to ounces of gold. Indeed more expensive ounces, but also more liquid. Plus, when you need to part with those 1/10 ounce bullion gold coins, they retain that "additional" value. So, nothing is actually lost.

So, when you reach your saturation point with silver, consider adding more wealth using gold.

If my predictions are all wrong and the dollar holds out you will be just fine. If, on the other hand, I am right and the dollar crashes - YOU WILL STILL BE just fine!

Here is the bottom line - pay attention now!

I have never done well investing! Terrible in fact. Everything I have done has been wrong. Buy high and sell low! That's me.

.JPG)

sFIZRKKQ0pBSZE7pHetQ~~60_57.JPG)