Since I began to focus more and more on coins I figured I'd offer up some more wisdom (ha) regarding what to look for when considering buying a coin.

Coins often become toned after years of being stored away. Vapors from drawer liners, coin roll paper, shelving paper etc. can cause all sorts of toning. Coin toning can intrinsically increase or decrease the value of coins.

Natural coin toning can be quite beautiful. It can also be outrageously

ugly.

|

| Overall toned. |

And because beauty is often times in the eye of the beholder, placing a value on a coin due to its toning can present problems.

|

| Rainbow toned. |

A coin that’s toned is in a normal "stage" of its life. It won’t

disintegrate away before your eyes. Even in worst cases, the tone color

will normally take centuries to reach its very darkest and usually its

least attractive appearance.

There are several factors in determining the value of a coin, but at the

very top for most people is its eye appeal. If a coin is ugly, unless

extremely rare, people aren’t going to buy it and the value will be lower.

If a coin is attractive AND toned, it’ll likely be worth more to some people.

With all things considered, a coin’s value is always going to be higher

when it’s NATURALLY attractive. Historically, beautifully toned coins

that are older garner a premium. It’s not just beauty that sets them

apart but their "uniqueness".

Above information copied with slight changes from: Coin News Net

However, as I have tried to point out before, I am interested in "value" for my dollars in the future when the Dollar crashes. I doubt if a coin with toning is going to be worth more at that time. People should be able to use them as barter, and who will care then what it looks like? A certain amount of value is attached to looking in good condition. But, toning? I seriously doubt it will matter when buying food with it.

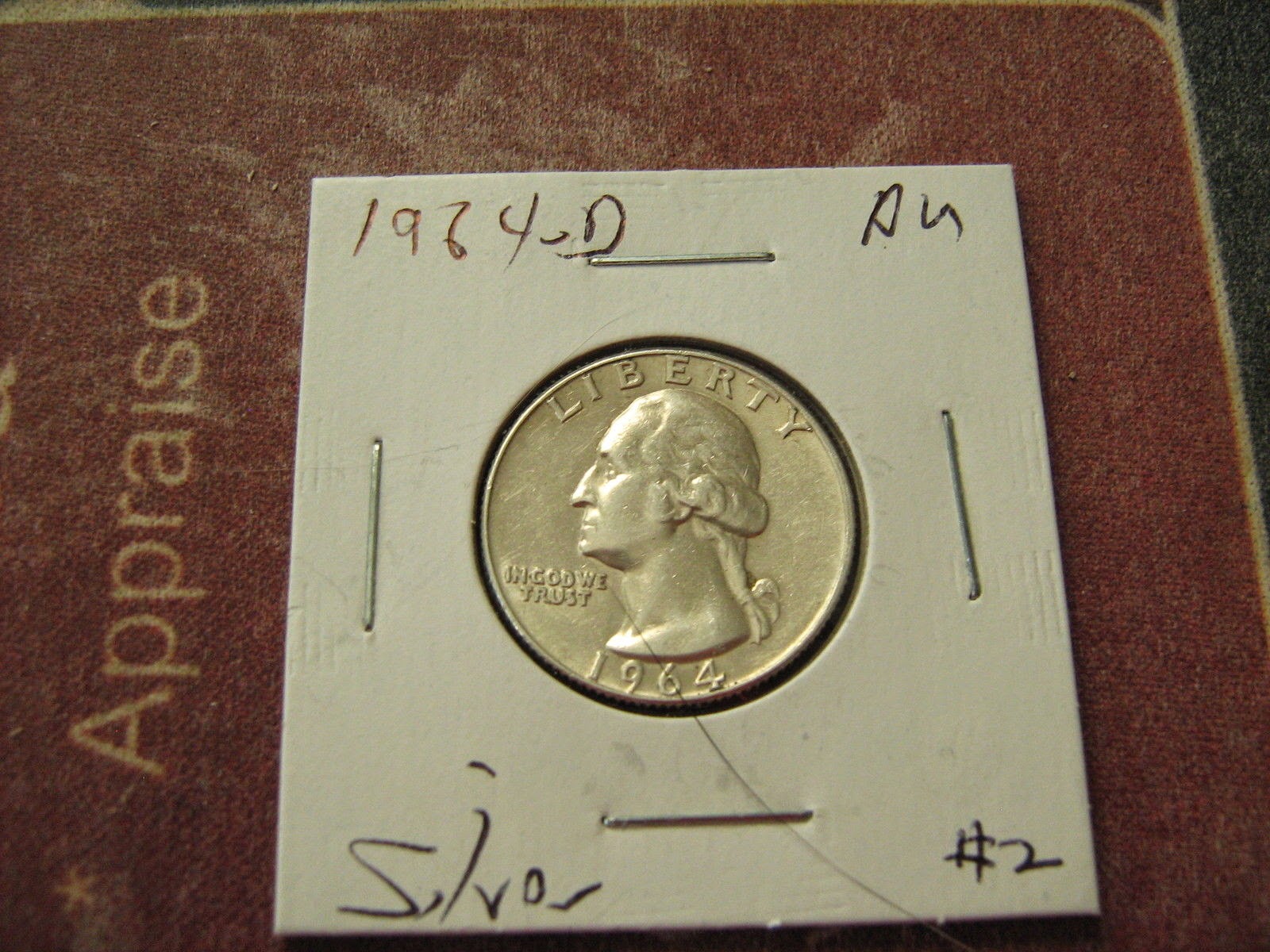

Personally, I prefer "blast white" as opposed to those which are toned.

|

| Blast white! My favorite. |

NEVER clean a coin. That can only reduce its value. By this I don't mean you shouldn't remove mud or dirt loosely on the surface if that ever happens. What I mean is do not dip a coin in Tarnex or use silver polish or rub it with a scratch pad!

I will dip a coin in rubbing alcohol then dip in distilled water after that for a rinse. Other than that - I do not clean the coins!

Of course, if you buy a certified coin it will not have been cleaned - or the slab description will state that clearly. The experts can always tell and it will be labeled by them as "Cleaned", and the value goes into the crapper!

Damaged coins:

Unless the coin is extremely rare and holds some numismatic value despite someone drilling a hole in it - avoid these. Think melt value ONLY!

There are people repairing some of these coins - making them look almost as good as ones not damaged. Some people collect type sets and need a particular coin to complete a set of "every one" of something. The one missing could cost an arm and leg so, to complete their set they will purchase these repaired coins. Unless that describes you, avoid like ebola!