Here is why I advised to make silver your first 20% of the portfolio. (remember - NEVER take my advice!)

The future holds two distinct possibilities, in my opinion.

Based upon a goal of $100,000 savings:

- Dollar crashes: In this case, if you have your twenty-thousand in silver (simply my "suggested" amount for illustrative purposed only) it will possibly go to a hundred an ounce or more. Thus your saved silver becomes the equivalent to $100K. Based on today's prices of about $20 an ounce. And your paper savings becomes just pretty wallpaper.

- Crash doesn't happen: You still have the silver and it is still worth $20K+-. And, you have the other investments, which should be $80K. Thus, this also yields you the 100K.

Another plus to this order of saving is that if the dollar crashes before you manage to obtain your other investments - you win!

|

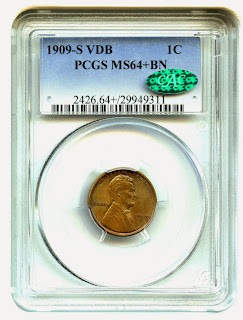

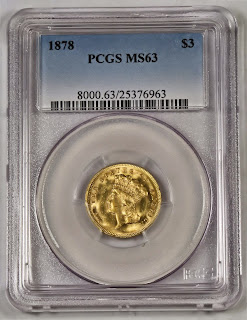

| ALWAYS has value. |

The single FACT here is that silver cannot ever become worth zero. It will always retain its store of value. Always has. Always will.

My second 20% will be a single-pay life insurance policy. In this case, for $20K.

Sidebar.

If you have a company 401K which your employer contributes towards, make sure you are invested in it for the amount they match. This can build up for your third 20%.

And, when buying silver, if the price goes down I'd keep buying. If it goes up I'd keep buying. It all balances out. Remember - it can never go to zero. Of course, if the dollar crashes and the prices go ballistic, stop buying! But, I didn't need to tell you that, did I?

Just my rambling opinions.