Here in no particular order are my personal TOP picks :

1. 1/10 and 1/4 ounce American Gold Eagles.

2. 1/10 ounce Gold Krugerrands.

3. Junk US silver - any/all denominations.

4. 1/2 and one-ounce silver rounds by any reputable dealer.

5. One ounce Canadian Silver Maple Leaf.

6. One ounce USA American Eagle silver dollars, any date. Some demand a premium - I avoid those.

7. One ounce silver bullion bars by any reputable dealer.

8. Certified US Morgan dollars - common date high production with the least added numismatic value.

9. 5 and 10 ounce silver bullion bars by any reputable dealer.

Brief explanations of some of my picks above:

#1 These smaller gold coins are still like a hundred dollar bill today! Easy to stash. Easy to carry around.

#3 Heavy on the Morgan dollars. Plus a roll or two of dimes and/or quarters.

#4 I currently prefer Sunshine Minting (see information about them below).

#5 Canadian Maples are one of the most recognizable silver coins on earth. Newer ones even have anti-counterfeiting engraving on them. Beautiful coin.

#6 Probably the most recognized new silver coins on earth.

#8 I avoid coins with a collector's premium due to mint errors or scarcity.

Silvertowne, JM Bullion and Sunshine Minting are people with whom I have had experience. They are reputable and a trusted source for my purchases. You can buy direct from Silvertowne (their own brand) while JM sells only other people's products. Sunshine products must be purchased in the secondary market. My experiences with AYDIN Coins and Jewelry as well as JM Bullion for Sunshine Mint products have been quite excellent. Again - bear in mind that I have absolutely no connection with these people whom I mention.

Many other suppliers, including most eBay dealers, are fine as well. I have no axe to grind here. Just my personal experiences is all.

Just buying silver or gold is one thing, but what is the reason to buy one type of silver vs. another? Here are examples of a few ways you can buy silver, some included in the lists above. Which is best? The choices are yours, but I'll add my opinion to each one.

First off, "junk" silver:

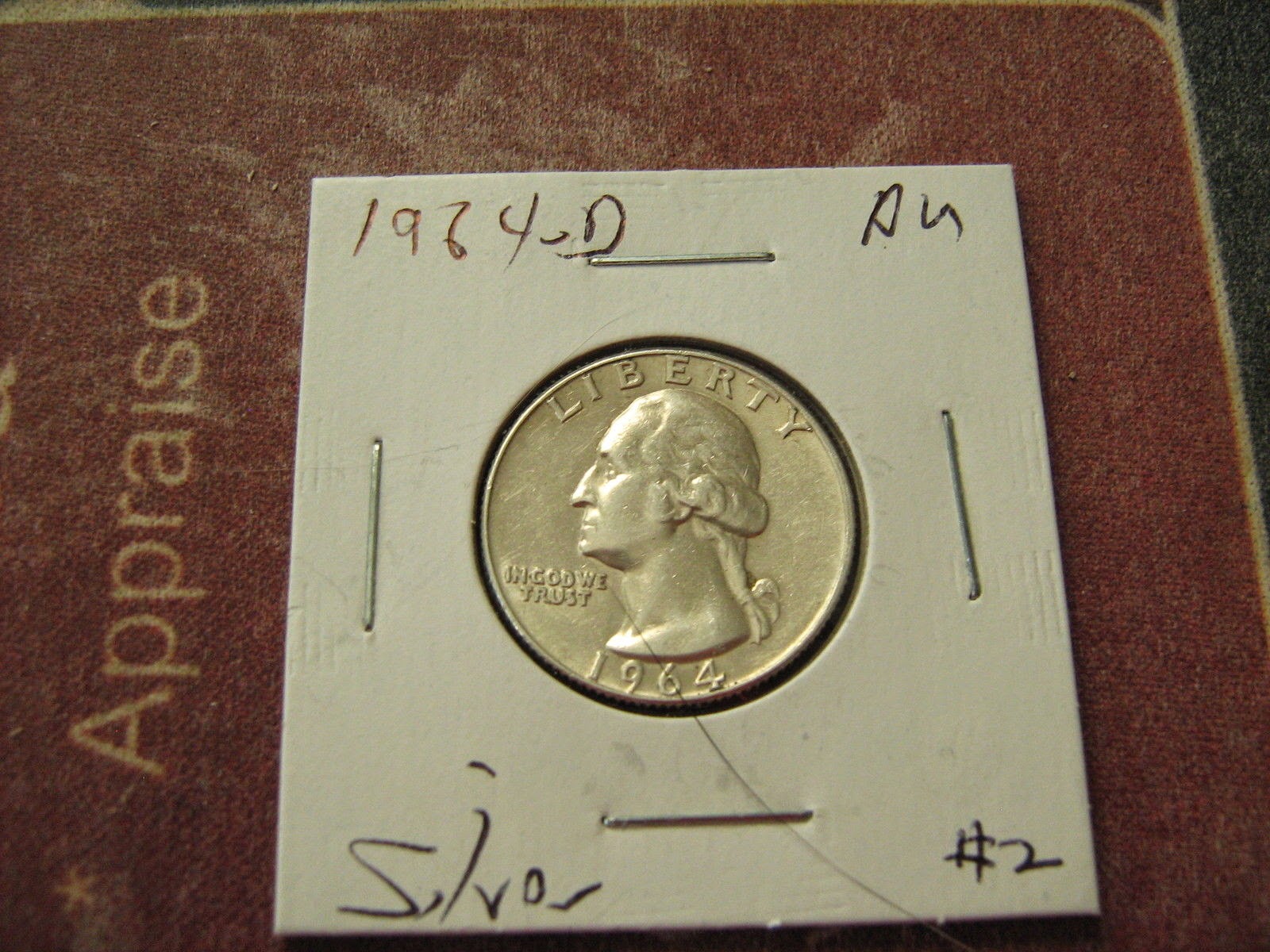

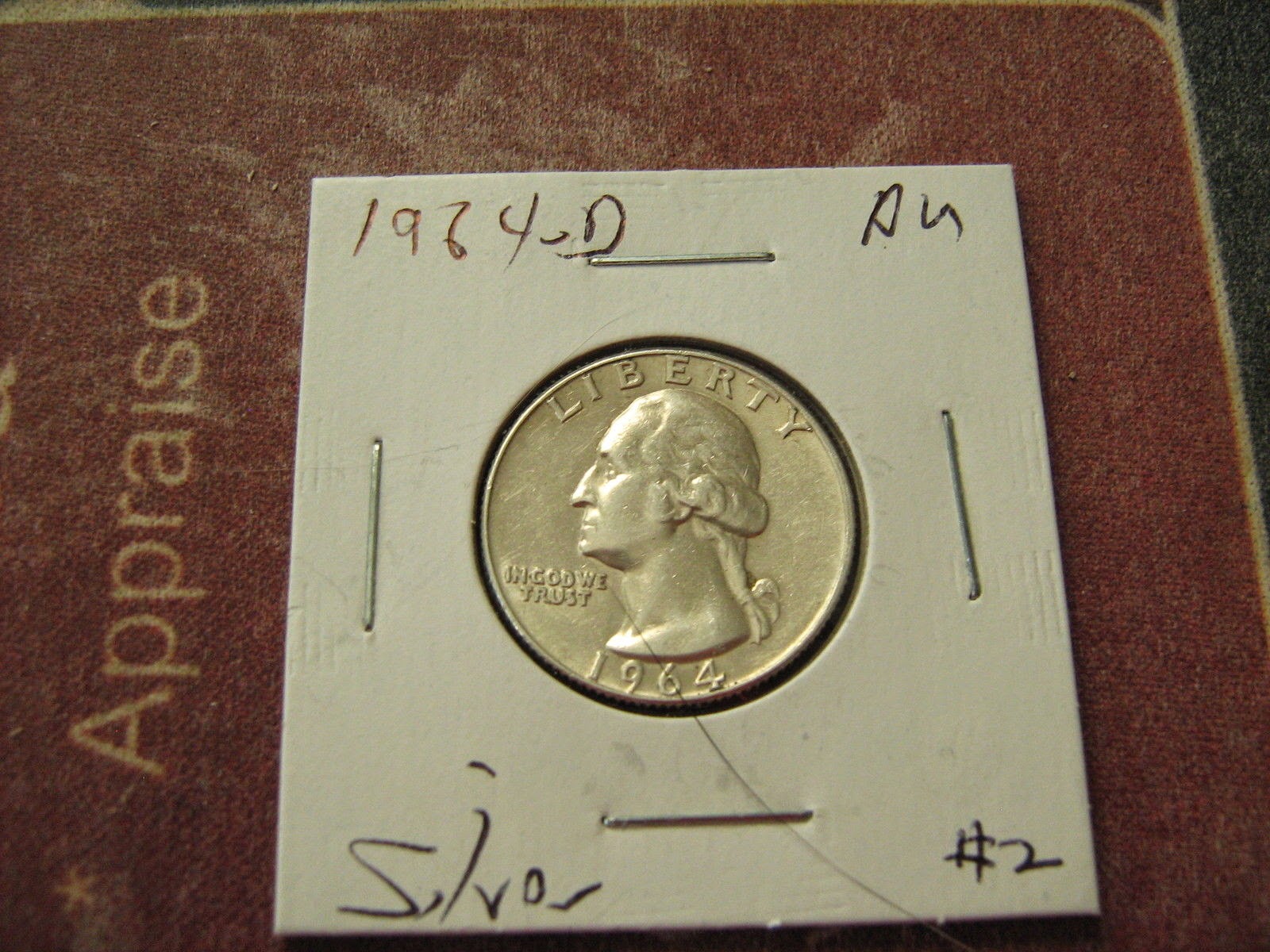

This is what? Anyone?

Yes. EVERYONE here knows what the above coin is. You all know it is a US quarter, plus you should know that, since it is older than 1965, it is 90% silver. Today's cost for this coin is minimal, albeit somewhat higher (per ounce of silver) than a silver bar for example would be.

|

| King of coins! |

This one is called a Morgan Dollar.

The coin designer was named Morgan. One of the most recognizable silver

dollars ever made. As a child I saw these in change all the time. If

you put a few hundred of these back for tough times you will probably be

pretty well off. Nobody counterfeits junk silver that I have ever heard

of, and in bad times just about everyone will know what this coin is worth.

Advantages: Very recognizable and certainly acceptable as silver coins, should the dollar crash. Easy to calculate value in purchases. Condition matters very little or not at all.

Disadvantages: Higher initial costs per ounce than many other sources of silver. Not practical for larger purchases. They are 90% silver and not pure silver (99.9%).

Next, silver bars or bullion bars:

This is a typical one ounce bar. They come in a variety of designs and are made by numerous companies. Many of these were made by companies which no longer are in business. A few demand a premium because of that. But, unless you intend to sell before the dollar crashes and turn a small profit - if they go up more - then I wouldn't worry much about who made the bar. The one pictured above has my name on it . . . almost!

|

| One ounce bars from Silvertowne. |

Advantages: Available in almost any size your heart desires. The least initial cost for silver, especially in larger bars. Very liquid and somewhat recognizable for what they are. Easy to care for and condition is not crucial but keep them looking good if you can.

Disadvantages: Larger bars, while costing less per ounce, are not as liquid as junk silver or smaller bars. There are counterfeits out there and it requires a constant vigilance - especially buying in the secondary market or from an individual. When selling these it will require enough knowledge to show others they are real. Sunshine Minting solves this problem with a validation hologram type emblem minted directly into the bar. Canadian Maples use micro printing now as well to discourage the crooks.

Next, silver rounds - also a bullion:

|

| Canadian issue five dollar coin (round). |

|

| United States silver eagle one dollar coin (round). This and the Canadian Maple Leaf are the two of the most recognizable coins in the world today. |

Called "rounds" these are similar to the bars other than shape.

The rounds are mostly one ounce or a half-ounce. Some are five ounce and

ten ounce. I haven't seen any larger than that, but they probably exist

somewhere.

Next, some words about Sunshine Minting:

Sunshine Minting holds a special place in my heart! As far as I know, they are the only ones that have placed the validation emblem on each bar and round produced. Older ones will not have that on them as this is relatively new for the company. Canada puts some micro printing on their newer coins (rounds). Geiger mints bars with a reeded edge to deter counterfeiting. Otherwise pretty much nothing I know of along those lines.

Quote from the SMI web page:

To help differentiate authentic SMI bullion from counterfeits, all SMI brand bullion products now have the new and innovative Mint

Mark SI™ security feature. Mint Mark SI™ is an exclusive Scrambled

Indicia security feature for all SMI brand bullion products. This is

micro-engraving that is only visible by placing the Mint Mark SI™

decoding lens over the security pad.

|

| Plastic decoder applied to bar yields the word "VALID". |

Sunshine Minting supplies the US Government with blank silver rounds to use in producing the US Silver Eagle dollar coin (round). The company which imprints these with the hologram like mark and supplies the decoder also makes the US Passport anti-counterfeiting pages and is quite good at what they do.

Next, slabbed and certified coins:

|

| A slabbed certified coin. |

Slabbed and certified coin is a term meaning placed in a plastic

protective slab. Certified means a group of experts has determined

exactly what the coin is, its condition, it is genuine and usually

guarantees to buy it from you for what you paid if they are wrong.

Pretty good I'd say!

Advantages:

Can hold their value better than pure silver in a downturn of the

silver spot prices. Leaves no doubt as to exactly what you are buying.

Generally are sell-able for what you paid based on what the silver spot

price does. Just plain beautiful and a piece of Americana in your hand!

Disadvantages: Prices

much higher than spot silver. Always consider the fact that a slabbed

coin cost someone about twenty-dollars to get it certified. These coins cost a

great deal more if you decide to buy other than common date, high

production, coins. There is the risk that when the dollar crashes these will become worth

no more than raw coins. Personally I doubt that will happen.

Foreign coins (Foreign to us here in the USA). There are a few worth obtaining here. The gold Krugerrand comes to mind. It is the original one-ounce gold bullion coin. Almost universally recognized. But, not made in silver.

Others are few and far between. Canadian silver coins are on a par with the US produced products. Even less susceptible to counterfeiting now with the micro printing. Some Mexican coins are made from silver. I know of no Mexican coins (rounds) which are nearly as recognizable as either the Canadian or US coins. But, silver is silver. Others like Great Brittan, Australia, Germany (Geiger) and such exist. But, personally I would focus on what will be recognized most easily where you live. Your perspective could differ if you are reading this in London or Switzerland for example. Invest wisely for where you are.

Remember - being easily recognized by you and a prospective buyer is VERY IMPORTANT both today and after the the dollar crashes.